estate tax law proposals 2021

Key Estate Planning Proposals September 21 2021 By Jeffrey G. Note the tension in current year planning if this proposal is adopted.

What Is The Tax Expenditure Budget Tax Policy Center

Fast Reliable Answers.

. Learn How to Create a Trust Fund with a Free Wells Fargo Estate Planning Checklist. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax. The current rate is an estate tax exemption of 11700000 per person 2340000 per married couple.

For 2021 the annual gift-tax exclusion is 15000 per donor per recipient. Potential Estate Tax Law Changes To Watch in 2021. Are Dental Implants Tax Deductible In Ireland.

California does not levy a gift tax. Again World War I created an urgent need for more government revenue. However on October 28 and then again on November 3 the House Rules.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Current Law in 2021 The current estate gift and generation-skipping transfer GST tax exemption is 117 million per person with a top tax rate of 40 which is set to sunset at the end of 2025 to pre-2018 levels to approximately 6 million 56 million adjusted for inflation. However the proposal was nixed from Bidens tax plan.

Bidens Proposed Gift and Estate Tax Changes. Ad Get the Personal Advice You Need To Start Planning A Living Trust. The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as adjusted for inflation presently 11700000 per person will be intact through the end.

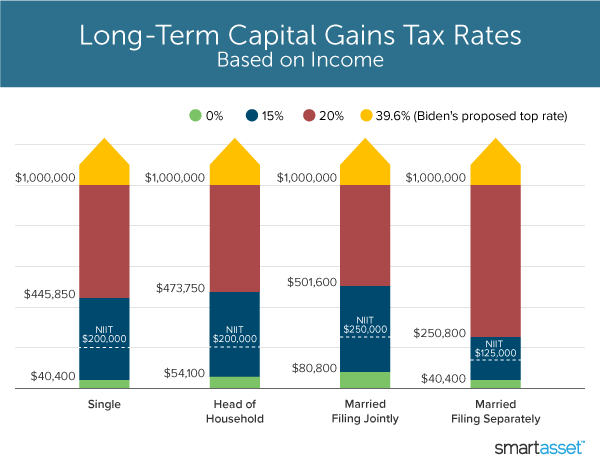

Capital gains tax would be increased from 20 to 396 for all income over 1000000. Unrealized gains would be taxed when assets transfer at death or by gift as if they were sold. However the federal gift tax does still apply to residents of California.

A summary of 2021 top ten developments includes discussions of the Covid challenge various legislative proposals pending anti-abuse changes to the anti-clawback regulations splitting gifts among transferors and among transferees donor advised funds John Doe summonses to law firms a new user fee for estate tax closing letters and the estate tax. It remains at 40. Federal tax laws allow for an annual exclusion amount that can be gifted from any one person to any other person in any given year without using up any estategift tax exemption.

Here is what we know thats proposed. From Fisher Investments 40 years managing money and helping thousands of families. A reduction in the annual gift tax exemption from 15000 per person per donee to an annual per donor maximum of 20000 per year.

2021 Federal Estate and Transfer Tax Law Proposals This year has brought many proposals to Congress that would dramatically change the. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. 2021-2022 Federal Estate Tax Rates.

31 2025 and decrease to approximately 55 million per person. Proposed effective date is retroactive to January 2021. Leading Federal Tax Law Reference Guides.

The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and. Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. Restaurants In Erie County Lawsuit.

On September 13 The Ways and Means Committee of the House of Representatives released sweeping tax proposals affecting both businesses and individuals. Note that both of these amounts are annually indexed for inflation. Click to play an audio version of this article.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The exemption was indexed for inflation and as of 2021 currently. No California estate tax means you get to keep more of your inheritance.

The Biden Administration has proposed significant changes to the income tax system. A giver can give anyone elsesuch as a relative friend or even a strangerup. Restaurants In Matthews Nc That Deliver.

New federal tax legislation is on the horizon with significant changes for estate and gift taxes. It is predicted that Congress will pass new tax legislation in the next few years that. Reduction in Federal Estate and Gift Tax Exemption Amounts.

Net Investment Income Tax would be broadened to cover more income if your total income was greater than 400000. What we now think of as federal estate taxes became law in 1916. The current federal transfer tax law allows individuals to transfer 118 million free of federal estate and gift tax to their heirs or beneficiaries but that is currently set to expire on Dec.

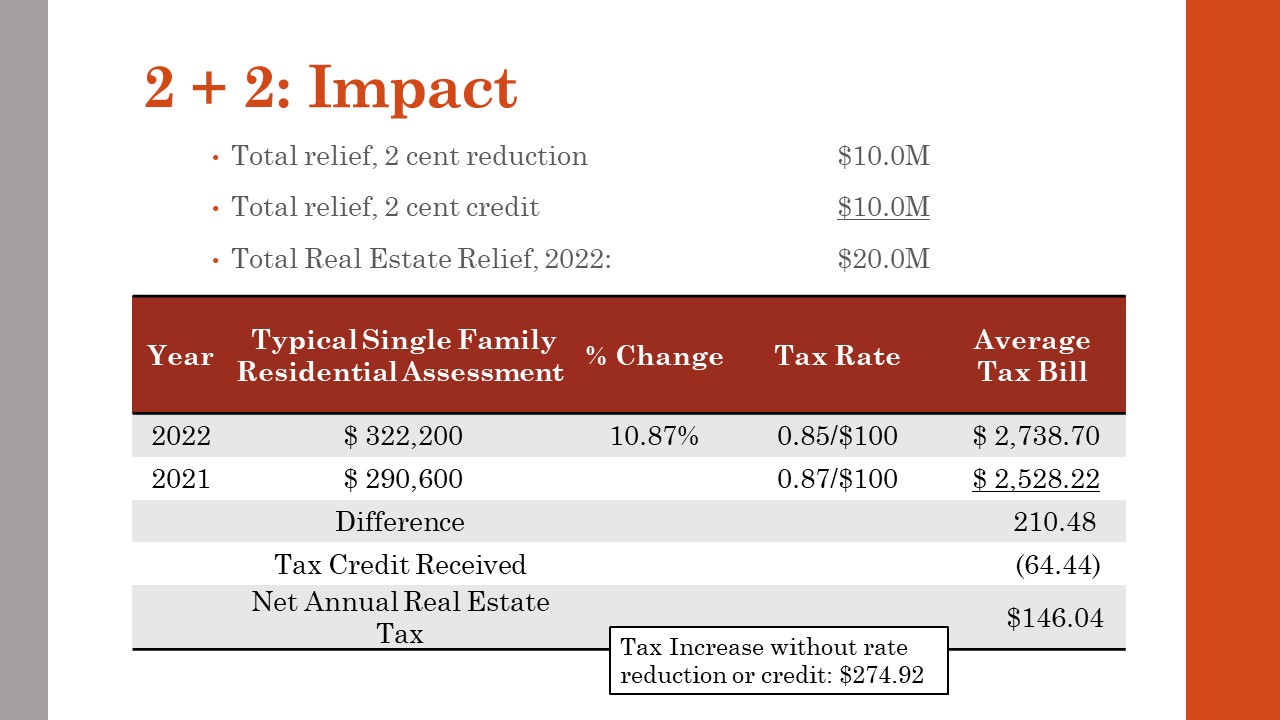

An additional surtax of 3 on MAGI over 25 million for a single person or married persons filing jointly bringing the total surtax for this group to 8. The House estate tax proposal is to accelerate the 2026 reduction to 2022. President Bidens Build Back Better plan currently wending its way through Congress.

Estate Tax Law Proposals 2021. Proposed Federal Estate and Gift Tax Legislation Estate Planning News By Sean Hocking KL Gates law firm prepared the following advice published to JD Supra Under the proposed legislation the federal estate tax exemption which is the amount of ones estate that can pass free from tax at death would be sharply reduced. Cherry Bekaert Article Estate Tax Planning Under the New Biden Administration July 13 2021 The current 2021 gift and estate tax exemption is 117 million for each US.

Ad Offers Comprehensive Explanations Of Topics Often Researched By Tax Professionals. 2021 Estate Tax Proposals. Moore Attorney in the Estate Planning Probate Practice Group This last week House Democrats released details of a new tax proposal to support the 35 trillion spending plan.

The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person 7000000 per married couple. Payment of the capital gains tax would secure the step up in basis at death. 18 0 base tax 18 on taxable amount.

November 16 2021 by Jennifer Yasinsac Esquire. A proposed surtax of 5 on modified adjusted gross income MAGI over 10 million for a single person or married persons filing jointly. The provision is that the increased exemption amount of 10000000 will revert back to 5000000 after December 31 2025.

The proposed impact will effectively increase estate and gift tax liability significantly. Opry Mills Breakfast Restaurants. 2021 Estate Tax Exemption.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Consumer IssuesConsumer Protection News and Events. A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office.

Any modification to the federal estate tax rate. By Cona Elder Law. An elimination in the step-up in basis at death which had been widely discussed as.

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

The New Certainties In Life Death Taxes Estate Planning The Ashmore Law Firm P C

Biden Tax Plan And 2020 Year End Planning Opportunities

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Summary Of Fy 2022 Tax Proposals By The Biden Administration

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Consider Wealth Transfer Strategies In Advance Of Proposed Tax Law Changes Mariner Wealth Advisors

It May Be Time To Start Worrying About The Estate Tax The New York Times

Biden Tax Plan And 2020 Year End Planning Opportunities

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra

What S In Biden S Capital Gains Tax Plan Smartasset

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Here S How Biden S Build Back Better Framework Would Tax The Rich

How The Tcja Tax Law Affects Your Personal Finances

Overview Of Proposed Tax Law Changes

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)